Someone perusing a Volvo showroom may not expect their Swedish-designed luxury vehicle to come from anywhere but Scandinavia.

And while the driftwood trim and crystal gear lever – as well as the Swedish flag tucked into the seat seam - may give every indication it’s from the Nordic depths, the reality is most Volvos sold here these days come from the People’s Republic of China.

It’s indicative of a shift that is changing the makeup of automotive manufacturing around the world - and helping shape our roads in Australia.

Whereas once China produced budget cars predominantly for its domestic market, mainstream brands are increasingly using China as a manufacturing base, while a handful of Chinese domestic brands are forging beyond their homeland.

That momentum will only grow as the world goes electric.

Sizing up the market

China’s growth comes from scale. A population of about 1.3 billion and a government-led desire to manufacture cars has transformed the country.

In 2009 China became the world’s biggest consumer and manufacturer of new vehicles. The rise of the Chinese middle class has seen car sales boom from a trickle to now account for about 27 million sales annually, almost one third of global production.

But Chinese vehicle ownership rates still pale compared with countries such as ours.

In Australia there are about 20 million registered vehicles for a population just north of 25 million, representing almost eight vehicles for every 10 people. In China less than one in four people own a car. Clearly there’s a lot more growth potential.

Heading down under

China is also emerging as an automotive giant in the Australian market.

Until 2019, cars sourced from China accounted for about 1 per cent or less, of the 1.1-million-odd new vehicles sold here each year.

But as Chinese manufacturers started refocusing their attention on Australia around 2019, that number started growing; 3.4 per cent in 2019, 11.4 per cent in 2021 and 16.5 per cent in the first half of 2023. Only Japan (27 per cent) and Thailand (21 per cent) send more cars to Australia.

Sales of cars sourced from China in the first half of 2023 are almost double what they were in the same period of 2022.

Dinesh Chinnappa is the general manager of LDV Australia, part of Ateco Automotive, which over the years has looked after brands as diverse as Suzuki, Kia and Citroen. He was also involved in early efforts to sell Great Wall Motors and Chery in Australia. He says it’s only a matter of time until China is the top supplier of vehicles to the Australian market.

“I don’t know when it’s going to happen but it’s going to happen. It’s just a question of timing.”

Chinese brands gaining a foothold

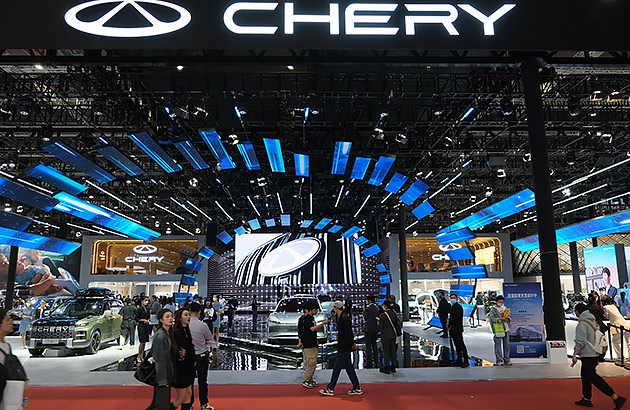

Over the past few years, a handful of Chinese brands have made big inroads on the Australian market.

LDV - known as Maxus in other parts of the world - is part of the massive SAIC group that also transformed MG from a brand known for its quaint British sports cars to one that is mass manufacturing SUVs and hatchbacks for buyers on a budget. LDV now accounts for almost 2 per cent of Australian new car sales - and growing. MG is honing in on 5 per cent of the market, also with healthy growth.

Great Wall Motors has rebranded as GWM and pulled the Haval, Tank and Ora sub-brands in under the same banner. While each has different badges on the bonnet, the combined might of the models means GWM is among the fastest growing brands on the market, with 2023 sales running at almost double the levels of 2022, in turn carving a healthy 3 per cent share.

The head of marketing and communications for GWM, Steve Maciver, says there is ample potential.

“Our brand awareness probably isn’t quite at the levels we expect it will get to in the coming years, and with that will be more opportunity,” he says, pointing out that there are plans to grow the brand footprint through its dealer network.

“There’s going to be new, improved and even better product coming, going into segments we’re not in today.”

Taking the electric lead

There’s one area where China is already leading the world: Electric vehicles (EV).

The nation’s industry is well advanced on electric propulsion and EV-only brands, something that was a strategic decision led by the government well before Tesla transformed the industry more than a decade ago.

LDV’s Chinnappa says the focus on electric was “absolutely strategic, absolutely planned” and sees the emergence of the new technology as pivotal to the charge of the Chinese car industry.

“Electrification has allowed China to leapfrog vehicle development timeframes,” he says. “It takes a brand 10 or 15 years to get brand equity. What electrification has done – because it’s a new technology, it’s a disruptive technology – it’s almost allowed China to do what Apple did to Nokia and Blackberry.”

Chinnappa believes Chinese manufacturers are “leaders in the electrification of transport and the others are playing catch-up.

RELATED:

Electric SUVs available in Australia »

World class products

A decade ago, it wasn’t difficult to find an excuse not to buy a Chinese-branded car.

Build quality often didn’t match the meticulous attention to detail from Japanese and South Korean brands and safety was sometimes not high on the priority list.

A 2012 recall of 23,000 Chery and Great Wall models for asbestos gaskets under the bonnet also hurt sales and confidence in the brands, something Chinnappa says was a result of “the newness of the business and a lack of international awareness for a burgeoning and young economy”.

The asbestos issue is a distant memory and other hangovers are fading fast.

Many modern Chinese cars have stylish designs, high levels of equipment and five-star ANCAP safety ratings. And quality is light years ahead of those early models.

But there are challenges

There’s no doubt cars from Chinese brands are getting closer to the best on the road. Whether it’s design, technology or quality, the likes of GWM, Chery and LDV are improving swiftly. But there are still areas to improve.

Some don’t have the crispness and driver engagement that we’ve come to expect from the likes of Mazda, Kia, Hyundai and Toyota. And GWM and Chery have been criticised for lacklustre driver assist systems.

Sure, things like auto braking and lane keep assistance tick the box on a brochure, but their sometimes overly aggressive nature on the road can be off-putting and deliver outcomes that go against what the technology is trying to achieve.

Maciver and Chinnappa say head offices are listening and improvements will come.

“They enjoy the volume that Australia represents,” says Chinnappa. “They want the business, they like the accolades that go with being successful in Australia, a mature, sophisticated market.”

A familiar path

The rise of Chinese-made vehicles is no different to the path taken by car makers from other countries.

In the 1970s and 1980s we learnt to love Japanese cars that have since gone on to be the most prolific on Australian roads. In the 1990s and 2000s it was Korean brands muscling into a busy and competitive market. There are parallels with the Chinese car makers today.

“It’s absolutely no different to the history of the Japanese auto manufacturers that then turned into the history of the Korean auto manufacturers that has now become the history of the Chinese manufacturers,” says Chinnappa.

In each instance there has been early reluctance from some buyers. There has also been resistance on other grounds, be that previous military conflicts or political positions. And in each instance the path to acceptance has been similar: identify a market segment, undercut key rivals and play the long game.

If the product lives up to expectations, then word soon gets around. Long warranties help with peace of mind. And the longer a brand is in the country, the more chance it has of catching the eye of buyers.

A decades-long plan

The Chinese automotive success story is far from an overnight sensation.

China’s car industry has been building and maturing for decades, with plenty of government assistance. More than 100 brands exist in China, most of which have little recognition outside their homeland.

Many of those brands have formed joint ventures with existing manufacturers, including Toyota, Volkswagen, General Motors and others.

It was a savvy move that allowed those big global manufacturers to join in on the booming domestic market while giving fledgling brands an insight into global manufacturing best practices.

Tesla was the first outside brand allowed to set up a factory in China without such a joint venture.

Western European brands increasingly turning to China

Until 2021, almost all cars sent to Australia from China were from Chinese brands; they included LDV, Great Wall, Chery, Haval and Foton.

But in 2022, brands from Europe and America started turning to China. Chief among them was Tesla, which ramped up its Shanghai factory in 2020 and swiftly switched all Australian production to the new facility. Tesla is now a top 10 selling brand and one that has benefited from Chinese manufacturing.

Volvo, too, started sourcing cars sold in Australia from China. Volvo Car Australia director, Stephen Connor, says there was some internal pushback early on but following the first batch of XC60s to come from China there’s been no looking back.

“I don’t think the customer minds,” says Connor. “As long as they know they’ve got the aftersales care if anything goes wrong with the car.”

There are other advantages too. Australia has a free trade agreement with China, which removes a 5 per cent additional cost. Plus, geography plays a role. Volvos sourced from China take about three weeks to be shipped here, whereas those from further afield take between six and nine weeks.

More to come from China

The Chinese brands on the Australian market are almost certainly just the start. Others including JAC and Nio are likely to make the plunge down under over the next few years.

Some of the existing Chinese brands also have grander plans to expand their ranges. Chery and BYD, for example, are currently developing utes aimed at the heartland of the market.

Throw in traditional manufacturers increasingly open to manufacturing in China and it’s certain we’ll soon see more Chinese-made cars on Australian roads.